Guest post originally published on the Virtasant blog by the Virtasant Research Team

FinOps enables cross-functional teams to work together, deliver faster, and manage their cloud costs better.

The appeal of the cloud is that it allows businesses to accelerate the delivery of strategic products and services while maintaining the agility to respond as the business landscape changes. But this ease and agility come with a price tag – spend on the public cloud is expected to grow by 18.4% to $304B in 2021.

When leveraging the on-demand features of the cloud, technology teams can rack up huge bills that can jeopardize the entire strategy of an organization. To prevent these runaway cloud costs from derailing the cloud journey, there is the need for an operating model that can break down the barriers between technology, business, and finance teams. By empowering them to operate at high speed while still maintaining financial accountability, businesses can retain the freedom to innovate without worry.

Enter FinOps‚ a model where cross-functional teams work together to enable faster delivery of cloud services while maintaining better financial control.

What is FinOps?

A few years back, the common refrain that J.R.Storment, President and Executive Director of the FinOps Foundation, constantly heard during interactions with executives was the lack of knowledge about the financial implications of cloud adoption. Subsequently, Storment realized that organizations had little understanding of cost efficiency when operating in the cloud. Simply adopting DevOps practices was not enough; something more was needed.

Teams that were trying to navigate the choppy waters of cloud financial management without a clear plan were struggling. On the other hand, enterprises that managed to decode FinOps were innovating at faster speeds and driving huge cost savings.

The quest for cloud financial management

The challenge came down to awareness. FinOps, being a brand-new operating model, was unknown to most companies. With no agreed-upon set of principles, companies were finding it difficult to implement FinOps processes in their respective teams. This prompted Storment and other practitioners to launch the FinOps Foundation in February 2019 to help cloud teams network and share best practices for cloud financial management. The founding members include the directors of companies like HERE Technologies, Nationwide, Atlassian, Australia Post, and Spotify.

The Foundation, which started with 30 members, now has over three-thousand. The community spans over 1400 companies and more than 30 countries. The rapid growth attests to the cultural shift within enterprises and their desire to collaborate on FinOps best practices.

Founding members J.R.Storment and Mike Fuller, published a comprehensive book on FinOps, Cloud FinOps: Collaborative, Real-Time Cloud Financial Management. Drawing on real-world examples, the book provides a reliable roadmap for companies looking to establish FinOps practices within their organization.

FinOps adoption phases

The FinOps Foundation suggests adopting an iterative approach to manage the variable spend in the cloud. This lifecycle consists of three distinct phases:

1. Inform

Teams gain visibility into the cloud environment and see what they’re spending on and why.

2. Optimize

Teams identify efficiency optimizations and align goals accordingly.

3. Operate

Teams continuously evaluate processes to ensure that IT, finance, and business meet their goals.

State of FinOps report 2021

The FinOps Foundation has recently released the State of FinOps Report 2021 which shines a light on how FinOps practitioners build their teams, the challenges they face, and how they solve them. Over 800 practitioners with a collective annual cloud spend of over $30 billion contributed to the survey.

Key takeaways:

We are still in the early stages. 43.5% of respondents are in the “crawl” phase of FinOps getting the basics in place while 41.5% are in the “walk” phase. Only 15% are in the “run” phase with an evolving and matured service.

There is very little automation of FinOps processes. Nearly half of survey respondents (and almost 70% of walk stagers) had little to no automation of managing cloud spend. Of those who automate, 31% send recommendations to teams while 29% automate tagging hygiene.

Finding Opportunities is Easy, Taking Action is Hard. 40% of respondents believed that getting engineers to take action on cost optimization is the biggest challenge they face. Other challenges included accurately forecasting spend (26%) and attributing shared costs (33%).

FinOps Foundation is a valuable asset. When faced with challenges, 78.33% of respondents reported turning to the FinOps Foundation for information.

Companies are in it for the long-term. 80% of Runners, 75% of Walkers, and 60% of Crawlers opted for Reserved Instances and Savings Plans. This proves that advanced cloud users targeted higher commitment rates to clouds.

The insights gathered from the survey help the FinOps Foundation solve key challenges that affect organizations as they adopt the public cloud at scale.

“The survey underscores that the challenges faced by large companies‚ cost, complexity of billing data, the changing nature of the cloud‚ are surprisingly similar to those faced by small companies,” Storment notes. “This supports the notion that developing FinOps best practices early on will pay huge dividends as cloud use and costs grow. The FinOps Foundation is perfectly positioned to help enable these best practices with our work in such areas as frameworks, benchmarking data, and certifications.”

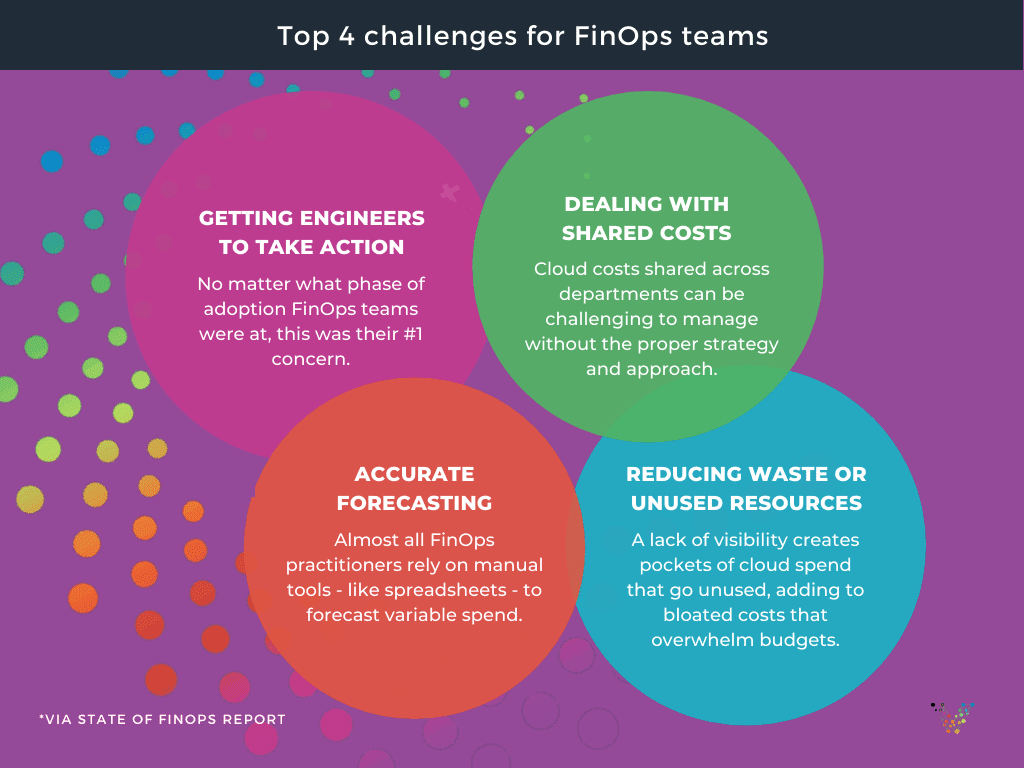

Common Challenges Among FinOps Teams

The State of FinOps 2021 report asked practitioners to rank the most common concerns, including: getting engineers to take action, accurate forecasting, dealing with shared costs, reducing waste or unused resources, full allocation of costs, container costs, aligning finance to tech teams and non-IaaS costs like SaaS.

Ranking them from 1-5, these were the areas of concern most often listed by FinOps practitioners.

Cloud optimization: a simple solution to a big problem

The cloud is an incredible platform that allows businesses to accomplish their goals and innovate at unparalleled speed. But, it also requires methods to maintain financial discipline and ensure cloud costs don’t spiral out of control. The big cloud providers are constantly evolving their platforms and offering new capabilities. This requires an ever-vigilant, constantly-evolving approach to cloud financial management.

The mission of the FinOps Foundation is to help organizations maintain this discipline while supporting their business goals. In other words, they preserve the reason the cloud is widely embraced in the first place – unparalleled speed, flexibility, and capability. This is where the FinOps Foundation and its community of cloud practitioners can help. They provide the tools, techniques and insights to help you balance the power of the cloud with financial responsibility.